Lessons for Leaders: Scott Galloway and the Future of Banking

He’s one of the most outspoken and respected voices in the business world, and you can meet him live in-person at The Financial Brand Forum this May. Here’s what senior leadership teams can learn from legendary iconoclast Scott Galloway.

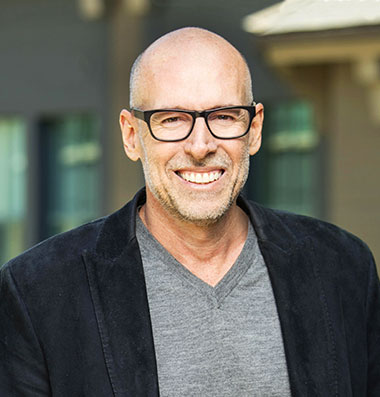

The New York Times calls him the “Howard Stern for the business world.” Fast Company says he’s a “progressive Jordan Peterson.” Others describe him as “Christopher Hitchens with an MBA.”

Scott Galloway, Professor of Marketing at New York University’s Stern School of Business, has made a name for himself as an outspoken, high-octane provocateur known for his uncanny predictions. He has become a pop culture icon, with millions of avid fans around the world by calling business leaders to account, dismantling myths, and dissecting over-hyped companies with an irresistible mix of candor, authenticity, and a self-deprecating sense of humor eschewing political correctness.

Galloway’s impressive track record as a serial entrepreneur, brand consultant, TV commentator, international speaker, and author gives him a lot of credibility.

Recognized as one of business world’s most influential thought leaders, Galloway regularly makes primetime TV appearances on major cable networks such as CNN, Fox Business, Bloomberg, CNBC, and PBS.

He’s been at the forefront of the digital economy since its earliest days. Of the nine companies he’s started, he’s sold two and took a third public.

Through a myriad of avenues — including a wildly-popular YouTube channel, one of the world’s top-ranked podcasts, and his No Mercy/No Malice newsletter — Galloway shares his unique perspective on business trends, emerging technologies, innovation, e-commerce, and digital marketing.

He’s also a major force on the speaking circuit, commanding stages at corporate events and industry conferences like The Financial Brand Forum, where he reportedly hauls in $50,000 for virtual gigs and as much as $250,000 for international events.